When the bank is on the verge of collapse, the deposited money of the account holders is returned through the Deposit Insurance and Credit Guarantee Corporation Act. Let us know about it in detail.

Many customers have savings accounts in banks, all their money is deposited with banks through FD etc. But suppose the bank with which your money is deposited goes bankrupt, then what will happen to your money? Have you ever thought about why banks collapse? Let us tell you about this.

This is how banks sink

When the bank’s liabilities exceed its assets and investors start withdrawing their money, the financial condition of the bank worsens. In such a situation, the condition of the bank worsens and it is unable to fulfill its responsibilities towards the customers. In this situation the bank is declared bankrupt. This is called sinking of the bank.

Why do banks sink?

Actually banks run on customers’ money. Banks give interest to customers on their deposits and earn money by lending and investing the money in bonds with high interest rates. But when the customer’s trust in the bank begins to waver, they start withdrawing money from the bank. In this situation, a situation of bank run arises in front of the bank, that is, at this time the bank has to sell its invested securities and bonds to return the money of the customers. Due to this, the financial crisis in the bank begins to deepen and there is a danger of it going bankrupt.

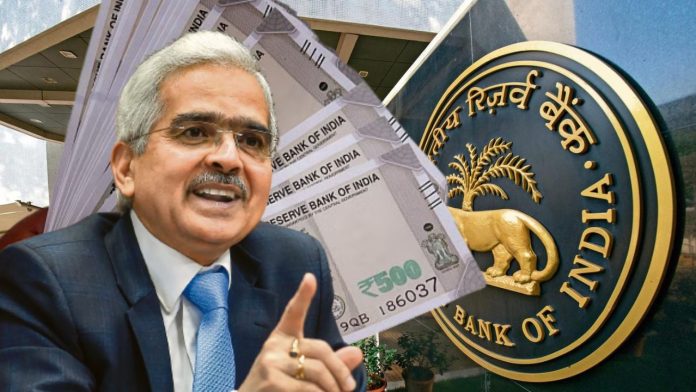

How will you get your money?

If a bank goes bankrupt, customers get insurance cover on their deposits under the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act. Let us tell you that earlier the deposit insurance on bank deposits was Rs 1 lakh, but now it has been increased to Rs 5 lakh, that is, after the bank collapses, the secured amount of Rs 5 lakh will be returned to the customers. In simple language, deposits up to Rs 5 lakh will be completely safe in the bank and the account holders will get it even if the bank goes bankrupt.